The visions of an apocalypse peddled by nihilistic humanists and misanthropic transhumanists confuse the destruction of humankind with salvation.

Rents are usually considered affordable when below around a third of a household’s income. But this rule of thumb is tailored to middle-class homes, ignoring the financial realities of low earners who struggle to cover necessities.

The housing question has been back on the political agenda ‘in full force’1 for some time. Formerly central questions about housing standards and overcrowding have been relegated to the background2, but one issue in particular has been thrust into the spotlight: the problem of housing affordability.3 Despite increasing attention being paid to the issue, it has become clear that there is a significant discrepancy between the notion of affordable housing and the precise manner in which it is defined. ‘Affordable’ increasingly rings hollow, not least in German-speaking countries.

In Berlin, the problem of housing affordability has only started to gain traction recently. Over the past eight years, market-rate rents have increased by around 50% throughout the city. A significant number of districts have even seen rents double over the same period.4 As a result, the burden of Berlin housing costs is now on par with Munich, Hamburg and Frankfurt am Main. Andrej Holm5 estimates that there is a shortfall of 200,000 apartments, the number required to guarantee affordability for households with low incomes and those subject to SGB II and SGB XII.6

This dramatic development has long been ignored by the Berlin Senate. Numerous rental initiatives repeatedly pointed out the problem with affordable housing and eventually initiated a 2014 rent referendum in which ‘all of Berlin voted on a law for affordable rents’.7 Thanks to the wide-reaching campaign, the Senate quickly began negotiating with representatives of the rent referendum. Finally, in 2015, the Berlin House of Representatives passed a Social Housing Provision Realignment Act, which takes up the central demands of the rent initiatives. Among other things, a ‘social housing benefit’8 was introduced to subsidize social housing tenants whose net rent exceeded 25-30% of their household income.9 Any housing cost burden below this rate is now considered affordable, regardless of one’s income bracket or household structure.

Protest at houses next to the revolutionary 1st may demonstration in Berlin

Photo by Leonhard Lenz / CC0 from Wikimedia Commons.

It has proven to be a welcome measure, one that can also be understood in terms of a ‘post-neoliberal paradigm shift in housing policy’.10 But both the way in which the social housing benefit was designed, and this arbitrary quota, have obvious weaknesses. On the one hand, the exorbitantly high ancillary costs in social housing construction have not been taken into account. On the other hand (and this is the more fundamental problem), the use of the 25-30% quota expresses a normative attitude that follows the logic of the so-called ratio approach, a rule of thumb whose relevance to housing policy has grown over time. Therefore, it is worth taking a look at the emergence of household statistics as part of modern economic and social statistics, and the way they have informed public discussions of housing costs, amongst other things.

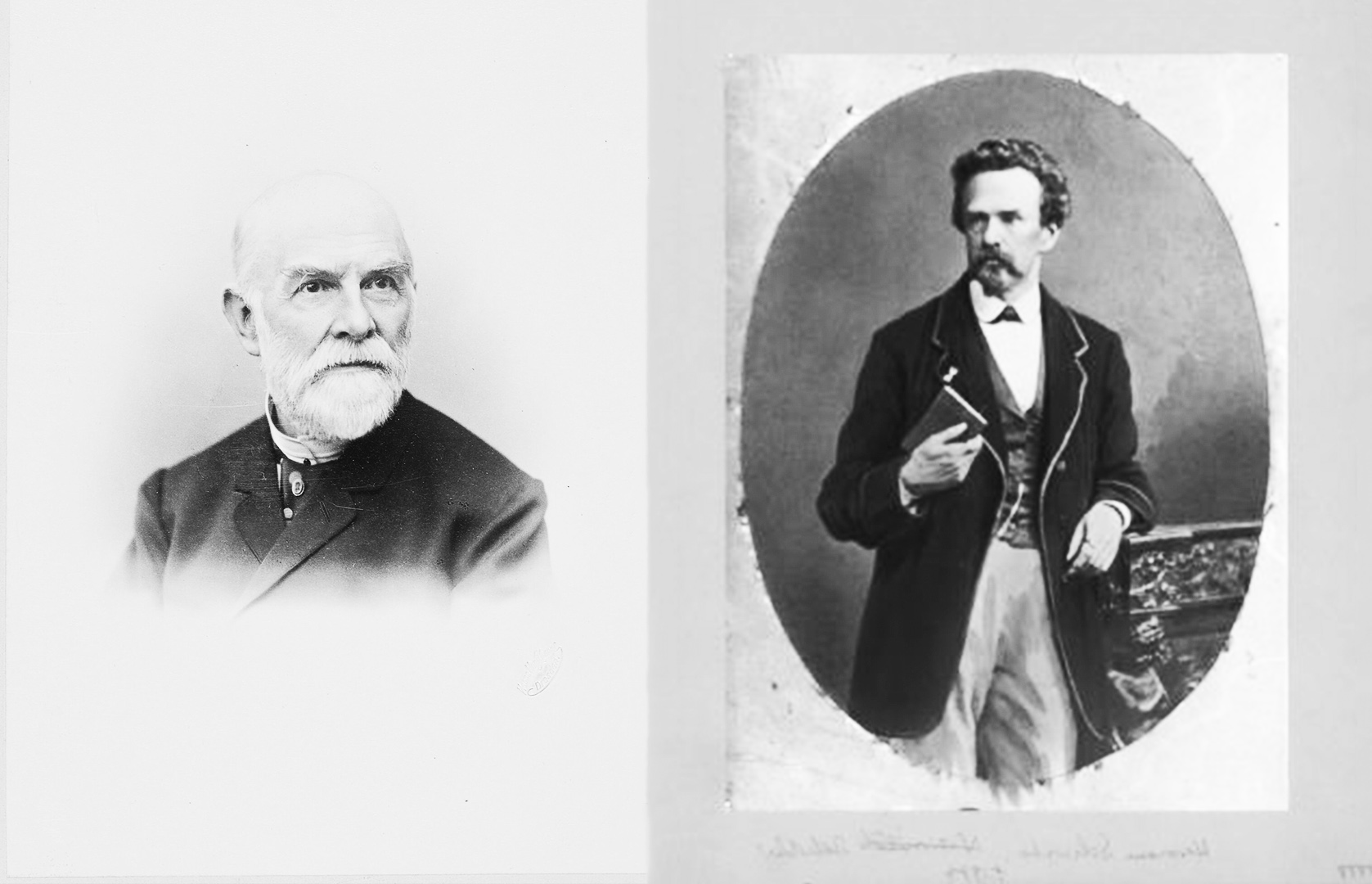

In his 1857 classic Die Productions- und Consumtionsverhältnisse des Königreichs Sachsen (Conditions of Production and Consumption in the Kingdom of Saxony), Ernst Engel, the long-time director of the Royal Saxon and Royal Prussian Statistical Bureau, used data that provided information about the cost of living for 153 Belgian working families, which he grouped into three socio-economic categories.12 It was from this material that he developed the so-called Engel’s law, according to which the food expenditure of individual households with declining incomes decreases absolutely, but increases progressively as a proportion. As he writes, ‘the poorer a family is, the greater part of its total expenditure must be spent on procuring food’.13

Engel arrived at a quite different assessment of the burden of housing costs, which he did not highlight specifically, but merely included in a summary table. This summary shows that the share of housing costs across all incomes amounts to 12%.14 Despite being the subject of intense debate in subsequent decades, David Hulchanski, a professor of housing and community development, has noted that ‘Engel’s 1857 survey of Belgian working-class families was one of the best known statistical analyses of budgets for many decades and the first to draw empirical generalizations from budget data’.15

While the question of the burden of housing costs only featured implicitly in Engel’s work, Hermann Schwabe’s 1868 study Das Verhältniß von Miethe und Einkommen in Berlin (The Relationship of Rent to Income in Berlin) deals with it explicitly and for the first time.16 Drawing on data from around 5,000 state and municipal officials as well as 10,000 other residents of Berlin, who paid income tax and had been surveyed for administrative purposes a year earlier, Schwabe, the director of the Municipal Statistical Bureau, showed that the share of housing costs rose from 2%, with an annual income of 80,000 Talers, to 28%, with an annual income of 1,100 Talers.17

The great statistician showdown: Ernst Engel versus Hermann Schwabe. The Engel portrait is the courtesy of Goerdten from Wikimedia Commons, Hermann Schwabe’s photo is the courtesy of Humboldt University Berlin’s Wissenschaftliche Sammlungen.

Schwabe proved that Engel’s law can be applied to housing costs as well as to food. In response to Engel, he even came up with his own law (Schwabe’s law) in which he summed up his assessment of the burden of housing costs: ‘the poorer a person is, the greater part of his income must be spent on housing’.18 The explosive power of this statement becomes clear enough ten years later when considering Rudolf Eberstadt’s assessment of the situation at that time, which owed a debt to Engel’s study: ‘when Schwabe carried out his investigation, there prevailed among the discipline a view opposite to the proposition stated above’.19

Over the course of the contradictory birth of the housing cost laws, the burden of housing costs served only as an indicator of an empirically verifiable situation. But from an early stage, it was used as a normative value. In the mid-nineteenth century, H. Krummel was already reporting that, ‘[T]he old norm of spending only 1/10 of one’s income on housing […] has long since become invalid; rather, the norm today is 1/8 to 1/6, or even 1/4’.20 Eventually, one week’s wage for one month’s rent established itself in the 1880s as a widespread rule of thumb, which hinted at the widely used ratio of income-to-housing costs, which was considered proportionate.21 Interestingly, this normative attitude is not a reflection of Schwabe’s rigorously supported law, but rather of Engel’s erroneous assessment of the burden of housing costs.22

A ledger of a German family from the 1930s. Photo by Andreas Praefcke / Public domain from Wikimedia Commons.

In the United States, home loans were expanded in the 1920s. The rule-of-thumb ratio would first indicate to private lenders whether households with low income would be able to cover their monthly repayments, and therefore whether the loans were affordable. During the Great Depression, the Federal Housing Administration made use of the 25% ratio, which was also used by the federal government to quantify the problem of housing affordability. Here, too, the simplicity of the ratio approach comes into play. A single ratio helps identify the proportion of the population for whom housing costs represent an excessive burden.23 The origin of its enshrinement into housing policy can be found in this period.

Over the course of the political-social upheavals at the end of the 1960s, the ratio approach was called into question. However, its critics did not succeed in introducing possible alternatives. Instead, the 1970s were characterized by the ratio’s increasingly widespread use. The 25% rate also served as a normative measure for subsidies in social housing: ‘By the early 1970s, the migration of the rule of thumb was complete: from an empirical norm of behaviour to a predictor of ability to pay, to a measure of affordability, to a standard of affordability and finally, to a guide for government subsidy for targeted populations’.24

However, the ratio approach was used in a more differentiated form in the 1970s, when a greater distinction was made between income bracket and household structure. It was only in the 1980s that there reappeared the simplified formula, still well-known today, according to which a single ratio should provide information about whether housing is affordable or not. The arbitrariness of the normative attitude that goes along with this formula is highlighted particularly well by the fact that the ratio was raised from 25% to 30% during this period.25

At the end of the 1960s, the critical debate on the ratio approach was at its fiercest and the U.S. President’s Committee on Urban Housing made the remarkable statement that ‘the staff concluded that no flat percentage can be fully equitable for all’.26 But nevertheless, the emergence, dissemination and institutionalisation of this formula in housing policy can be read, with Roland Barthes in mind, as a form of ‘depoliticized speech’ in which the myth of affordability is established and neutralized.27 In its blindness to alternatives, it ‘transforms history into nature’ and serves to enforce ‘bourgeois norms’ which ‘are experienced as the self-evident laws of a natural order’.28

In Germany, the situation was initially different. Despite this, however, references to the use of the rule of thumb can also be found: ‘in 1972, the lower income quartile had to spend 36% of their weekly household income on rent, excluding service charges’.29 However, if one looks at early housing laws, it is striking that access to social housing was dependent solely upon one’s annual income. This is due not least to the fact that social housing was primarily used to offer the market relief by expanding the housing supply, at least from the mid-1970s onwards. And, increasingly, it was used to offer this relief regardless of who actually lived in social housing.30

However, the 1994 Housing Construction Promotion Act involved income-aligned additional support for the first time, the precise form of which was the responsibility of the respective federal states. One of the key points adopted by the 2012 Alliance for Social Housing Policy and Affordable Rents in Berlin relates to this policy and indicates that the level of housing cost burden in the holdings of urban housing associations should not exceed 30% after a rent increase.31 Meanwhile, the aforementioned Social Housing Provision Realignment Act transformed this key point into a norm.

Public housing in Berlin Neukölln. Photo by Oliver Elser & Andreas Muhs / restmodern.de via Flickr.

But things were different with housing benefit. The ratio approach was used from the beginning, but never in its simplified form. At the time of the first Housing Benefit Act of 1965, the amount of housing benefit was still measured on the basis of relative housing costs. The second Housing Benefit Act of 1970 included a modified housing benefits table with absolute values, the aim of which was to make it easier for housing benefit staff to provide information about people’s respective entitlements to housing benefit. However, both variants shared the same logic in terms of how to establish different income brackets and household structures. They are, therefore, close to the more differentiated use of the ratio approach, which was common in the United States in the 1970s. This logic is still in use today and is reflected in the housing benefit formula.

Nevertheless, the housing cost burden rates in the current Housing Benefit and Rent Report were calculated for the first time on the basis of the Eurostat definition of the housing cost burden.32 This represents an interesting innovation in that it is accompanied by an approximation of the normative parameter of the housing cost overburden rate, according to which housing costs in Europe are seen as affordable where they fall below a burden of 40%.33

In Germany, therefore, the spread and institutionalisation of the ratio approach in housing policy was not consistently analogous to the same process in the United States. Nevertheless, increasingly strong convergences can be seen, especially in recent years, which make the use of a single ratio seem almost unquestionable.34 A gradual neutralization of the myth of affordability is at work here, one that says that a single ratio can tell us whether or not housing is affordable.

During the 1970s, Michael E. Stone became known as a consistent critic of the ratio approach. According to him, the obvious weaknesses of an arbitrarily determined rate can be illustrated by a simple calculation. In present-day Germany, this would look as follows: while a four-person household with a monthly income of 1,000 euros is faced with a housing cost burden of 30%, a one-person household with a monthly income of 10,000 euros can easily spend significantly more than 3,000 euros per month on housing costs.35

For this reason, Stone proposes the residual income approach as an alternative to the normative ratio approach. According to him, an absolute minimum amount must first be defined, one that is flexible across time and space, and, depending on the household structure, satisfies all the needs of life aside from housing. This minimum standard is then to be deducted from the income in question, whereupon the maximum possible amount that that household can spend on housing costs becomes apparent. As he writes, ‘In this way, the residual income standard emerges as a sliding scale of housing affordability with the maximum affordable amount and fraction of income varying with household size, type, and income. Indeed, it implies that some households can afford nothing for housing, while others can afford more than any established ratio’.36

Stone identifies all households with housing costs higher than the amount calculated for them as being shelter poor. In this way, he is able to shift the focus away from the arbitrarily defined ratio of income-to-housing costs to actual remaining income – and thus the basis of life – for different households. Interestingly, the total number of households affected by shelter poverty is only slightly different from the total number of households with a housing cost burden of more than 30%. But, unlike with the conventional approach, lower-income and larger households loom much larger.37

In the German-speaking world, the residual income approach has had a limited reception thus far.38 However, a number of recent studies implicitly follow its logic. For example, the housing policy concept produced by the Potsdam government features an ‘absolute minimum amount as a monthly household living costs budget’39 which must remain after deducting housing costs in order to guarantee the affordability of housing. Also, in his study on social housing needs in Berlin, Holm works with ‘monthly residual amounts after deduction of rent’,40 which should provide information on the affordability of housing.

For these reasons, it is imperative that the myth of ‘affordability’ is debunked both in the sciences and in urban social movements.

Christopher Dell, Ware: Wohnen! Politik. Ökonomie. Städtebau (Berlin: Jovis, 2013), p. 15.

See the following: Christine Whitehead, ‘From Need to Affordability. An Analysis on UK Housing Objective’, in Urban Studies, 28.6 (1991): pp. 871-887; Peter Linneman and Isaac Megbolugbe, ‘Housing Affordability: Myth or Reality?’, in Urban Studies, 29.3/4 (1992): pp. 369-392.

Due to its traditionally liberal or early liberalized housing market, this was first the case in the Anglo-American world. See Chris Paris, ‘International Perspectives on Planning and Affordable Housing’, in Housing Studies, 22.1 (2007): pp. 1-9 (p. 2). In the German-speaking world, the debate took longer to get started. See Barbara Schönig, ‘Die neue Wohnungsfrage’, in Blätter, 2 (2013): pp. 17-20.

Andrej Holm, Sozialer Wohnraumversorgungsbedarf in Berlin (2016), p. 4.

‘SGB’ stands for Sozialgesetzbuch (the codification of social law in Germany). ‘SGB II’ regulates the basic security for jobseekers, while ‘SGB XII’ regulates social benefits.

See Mietenvolksentscheid e. V., Warum Volksentscheid?, 2014.

Jan Kuhnert, ‘Soziale Aufgaben für öffentliche Wohnungsunternehmen. Gesetz erzwingt Neuorientierung der Wohnungsunternehmen von Berlin’, in vhw FWS, 2 (2016): p. 63.

See Abgeordnetenhaus von Berlin, Vorlage – zur Beschlussfassung – Gesetz über die Neuausrichtung der sozialen Wohnraumversorgung in Berlin (Printed document 17/2464, 2015), p. 7.

See Joscha Metzger and Sebastian Schipper, ‘Postneoliberale Strategien für bezahlbaren Wohnraum? Aktuelle wohnungspolitische Ansätze in Frankfurt am Main und Hamburg’ in Wohnraum für alle?! Perspektiven auf Planung, Politik und Architektur, edited by Barbara Schönig, Justin Kadi, and Sebastian Schipper (Bielefeld: transcript, 2017), pp. 178-212.

As part of his project to resolve open methodological questions in economics, Heinz Haller distinguished between strict and non-strict rules of thumb as well as pure laws. According to this categorisation, so-called laws regarding housing cost burdens are in fact non-strict rules of thumb. See Heinz Haller, Typus und Gesetz in der Nationalökonomie. Versuch zur Klärung einiger Methodenfragen der Wirtschaftswissenschaften (Stuttgart: Kohlhammer, 1950), p. 42ff.

See the following: Gerhard Albrecht, Haushaltungsstatistik. Eine literaturhistorische und methodologische Untersuchung. (Berlin: Carl Heymanns, 1912), p. 42; George Stigler, ‘The Early History of Empirical Studies of Consumer Behaviour’, in The Journal of Political Economics, 62.2 (1954): pp. 95-113 (p. 98-99).

Ernst Engel, ‘Die Productions- und Consumtionsverhältnisse des Königreichs Sachsen’, in Die Lebenskosten belgischer Arbeiter-Familien Früher und Jetzt, by Ernst Engel (Dresden: C. Heinrich, 1895), Appendix 1, pp. 1-54 (pp. 28-29).

Ibid., p. 30.

David Hulchanski, ‘The Concept of Housing Affordability. Six Contemporary Uses of the Housing-Expenditure- to-Income-Ratio’, in The Affordable Housing Reader, edited by Elizabeth Mueller and Rosie Tighe (New York: Routledge, 2013), pp. 79-94 (p. 81). This applies not least to the US, although Caroll Wright, the Director of the Massachusetts Bureau of Statistics of Labor at the time, misused Engel’s study in the Sixth Annual Report of 1875, a misunderstanding which would prove to be a source of lasting irritation in the modern economic and social statistics. He did not distinguish between Engel’s law as applied to foodstuffs and Engel's further assessments, which are merely presented in tabular form. His rather free translation into English makes up a total of four laws (see Stigler, p. 99). He rendered Engel's assessment of the burden of housing costs as follows: ‘that the percentage of outlay for lodging, or rent, and for fuel and light, is invariably the same, whatever the income’ (Massachusetts Bureau of Statistics of Labor (MBSL), Sixth Annual Report of the Bureau of Statistics of Labor (Boston: Wright & Potter State Printers, 1875), p. 438). According to Danilo Pelletiere, Wright was using a rhetorical trick, using an ambiguous translation to strengthen his own opposing position (Danilo Pelletiere, Getting to the Heart of Housing’s Fundamental Question: How Much Can a Family Afford? (2008), p. 9). Subsequent readings, however, often seemed to miss the fact that a few pages later, on the basis of an examination of the living conditions of 397 working-class families in Massachusetts, he unequivocally refuted Engel’s assessment of housing costs: ‘as regards fuel, the law is quite generally varified; but its propositions as regarding clothing and rents are plainly disproved’ (MBSL, p. 441). This context should make it clear that Wright’s free translation of the four supposed laws was used as the first reference source for Engel’s law even decades after its publication, without drawing attention to its partial refutation (see Stigler, p. 99).

See Emil Weber, ‘Einkommen und Wohnkosten’, in Handwörterbuch des Wohnungswesens, edited by Gerhard Albrecht (Jena: Gustav Fischer), p. 217; Hulchanski, p. 81.

Hermann Schwabe, ‘Das Verhältniß von Miethe und Einkommen in Berlin’, in Das Verhältniß von Miethe und Einkommen in Berlin (Ludwigshafen: Hausbau Rheinland-Pfalz, 1966), p. 1-2.

Ibid., p. 4.

Rudolf Eberstadt, Handbuch des Wohnungswesens und der Wohnungsfrage (Jena: Gustav Fischer, 1920), p. 193.

H. Krummel, ‘Ueber Arbeiterwohnungen und Baugesellschaften’, in Zeitschrift für die gesamten Staatswissenschaften, 14.1 (1858): pp. 105-149 (p. 109).

See Judith Feins and Terry Lane, How Much for Housing? New Perspectives on Affordability and Risk (Cambridge, MA: Abt Books, 1981), p. 8; Hulchanski, p. 82.

Here, the irritations described in footnote 15 may have played a role in America with regard to Engel’s law.

Ibid., pp. 9-12; p. 44; Pelletiere, pp. 1-2.

Pelletiere, p. 4.

Ibid., pp. 4-5.

See U.S. President’s Committee on Urban Housing, A Decent Home (Washington: Government Printing Office, 1968), p. 42.

Roland Barthes, Mythen des Alltags, trans. Horst Brühmann (Berlin: Suhrkamp, 2012), p. 295.

Ibid., p. 278; p. 292.

Rudi Ulbrich, ‘Entwicklung und Stand der Wohnungsversorgung’, in Sozialer Wohnungsbau im internationalen Vergleich, edited by Wilfried Kaib and Walter Prigge (Frankfurt am Main: Vervuert, 1988): pp. 80-93 (p. 86).

Ibid., p. 82ff.

See Senatsverwaltung für Stadtentwicklung und Umwelt Berlin (SenStadtUm), Bündnis für soziale Wohnungspolitik und bezahlbare Mieten, 2012.

See Bundesministerium für Umwelt, Naturschutz, Bau und Reaktorsicherheit (BUMB), Wohngeld- und Mietenbericht 2014, (2015), p. 61-61.

See Eurostat, Glossary: Housing Cost Overburden Rate, 2014. The deviation from the widely used 25-30% rate results from the European definition of housing costs, which are made up of gross rent and electricity costs and are thus significantly higher than the net ‘cold’ rents usually used.

Significantly, the Federal Ministry for the Environment, Nature Conservation, Construction and Nuclear Safety (Bundesministerium für Umwelt, Naturschutz, Bau und Reaktorsicherheit (BUMB), Bündnis für bezahlbares Wohnen und Bauen, 2015.), which is responsible for the Alliance for Affordable Construction and Housing, does not use an exact definition of its name-giving term affordable.

Michael E. Stone, Shelter Poverty. New Ideas on Housing Affordability (Philadelphia: Temple Press University, 1993), p. 34.

Michael E. Stone, ‘What is Housing Affordability? The Case for the Residual Income Approach’, in Housing Policy Debate, 17.1 (2006): pp. 151-184 (p. 164).

Stone, Shelter Poverty, pp. 32-33.

This may be related to the comparative difficulty inherent in rendering the residual income approach operational. See Alex Schwartz, Housing Policy in the United States (New York: Routledge, 2015), p. 36. The appendix to Stone’s Shelter Poverty explains how Schwartz arrived at this assessment (see pp. 323-343).

See Landeshauptstadt Potsdam, Wohnungspolitisches Konzept für die Landeshauptstadt Potsdam (2015), p. 21.

See Holm, p. 28.

Subscribe to know what’s worth thinking about.

The visions of an apocalypse peddled by nihilistic humanists and misanthropic transhumanists confuse the destruction of humankind with salvation.

Voicing opinions to explain political tensions from afar is contentious for those treated as mute subjects. Focusing solely on distant, global decision-making disguises local complexity. Acknowledging the perspectives of East Europeans on Russian aggression and NATO membership helps liberate the oppressed and open up the debate.